United Arab Emirates

United Arab Emirates |

|

Investment Climate The UAE presents a favorable business environment. Excellent infrastructural facilities coupled with professional expertise and customized services give the UAE an edge over other countries. The UAE was ranked 16th globally, as per the World Bank’s Ease of Doing Business Report 2020.(1) In the UAE, foreign investors can establish a business choosing from more than 40 designated Free Zones, each operated by different rules and regulations but all allowing for 100% foreign ownership. The different Free Zones serve businesses in technology, media, finance, and import/export industries. Additionally, investors in these Free Zones are exempted from import duty. Major advantages of investing into UAE include:(2)

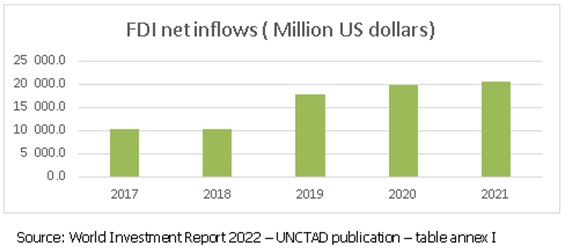

Investment Framework: The UAE issued the Federal Decree Law No. 32 of 2021, which updates and replaces the Commercial Companies Law of 2015. The new law allows for 100% foreign ownership of companies in the UAE with the exception of some activities of strategic importance to the UAE. Enabling foreigners to establish and fully own companies in the UAE, these amendments allow full freedom for investors to manage and operate private investments. To read the Full Federal Decree Law:(3) https://www.moec.gov.ae/documents/20121/376326/Commercial+Companies.pdf/12d14f53-1a3e-47b4-8e70-fac3f672c403?t=1645596097819 FDI inflows The UAE's National Agenda for Inward Foreign Direct Investment (FDI) aims to attract foreign direct investment through programs, policies and initiatives that align with the strategic visions of the UAE, including the UAE Vision 2071. FDI inflows targeted sectors:(4) In 2019, the UAE was in the top 25 worldwide of host economies for FDI inflows, ranking 22nd .The plan outlined in the Projects of the 50 is to increase total FDI outflows by 14% by 2030. Despite the COVID-19 pandemic, FDI flows in the UAE rose to USD 19.9 billion in 2020 and 20 billion in 2021, a 11.2% increase compared to inflows in 2019. Oil and gas investment deals were the main drivers of FDI. Although natural resources transactions drove inward investments, 53% of FDI directed towards Dubai in the first half of 2020 were in medium- and high-tech sectors such as pharmaceuticals.(5)

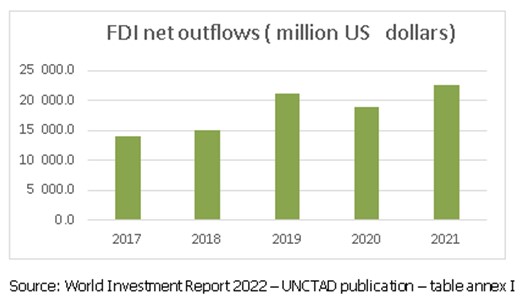

FDI outflows: With respect to investment abroad, the national agenda seeks to strengthen the international presence of the UAE's leading companies, open new opportunities for Emirati investors in targeted sectors and markets, foster technology transfer, and protect the interests of Emirati investors abroad. The UAE is deemed to be the largest Arab investor abroad. According to the UNCTAD statistics, the Emirati FDI outflows reached USD25 billion in 2021, compared to USD14 billion in 2017. (6) FDI outflow targeted sectors:

(1) The UAE's Government Portal.(2) Trade Policy Review , 2022 , WTO.(3) Ministry of Economy (MOEC).(4) WTO, Trade Policy Review, 2022.(5) Ibid.(6) World Investment Report 2022- UNCTAD Statistics. |