Kingdom of Saudi Arabia

Kingdom of Saudi Arabia |

|

Investment Climate One of the key goals of Vision 2030 is to increase foreign direct investment into the country from 3.8% of GDP to 5.7%. Hence, the Government actively seeks to attract investment projects that promote the development of non-oil sectors, transfer foreign technology and expertise, create new jobs, and increase exports. The objectives for investment for the Kingdom include:

Several sectors have been identified as priority sectors for foreign and domestic investment, including:(1)

Investment guide on how to start investing in Saudi Arabia https://www.investsaudi.sa/en/investor/guide(2) Ministry of Investment (MISA)(3) The MISA has an overall responsibility for setting and implementing policies to attract local and foreign investment, formulating investment policies, proposing plans to enhance the investment climate, issuing investment licenses, and assisting investors to set up and operate their businesses. It provides a wide range of services to investors, supporting them along the different phases of their investment project, through its five Business Centers located across the country. The MISA has launched several initiatives that aim to improve the investment environment and foster competition. Notably, it has issued the Consolidated Investment Plan, aimed at working closely with all relevant government agencies and leading Saudi companies to attract investment and channel it into the most promising economic sectors, while also making the traditional sectors more competitive. Other initiatives are geared towards marketing investment opportunities in the Kingdom in cooperation with the chambers of commerce. Invest Saudi(4) As a key initiative of the National Transformation Program, Invest Saudi was created by the General Investment Authority (SAGIA) to be the national investment promotion brand of the Kingdom. Invest Saudi is a communication platform that serves all government entities with regards to promoting the Kingdom as a future-ready investment destination, thus contributing to realizing Vision 2030. Invest Saudi is tasked with promoting the enormous investment opportunities in Saudi Arabia to the world and strengthening the Kingdom’s investment environment image. List of investment opportunities in the Kingdom: https://www.investsaudi.sa/en/sectors-opportunities/opportunities(5) Public Investment Fund (PIF)(6) The Public Investment Fund is considered Saudi Arabia’s Sovereign Wealth Fund, a pivotal factor in achieving the Kingdom’s Vision 2030, and a leading economic catalyst, by contributing to non-oil GDP growth and investing in opportunities across diversified sectors. PIF is developing a portfolio of high-quality domestic, regional and international investments diversified across sectors, geographies, and asset classes. Joining forces with top-tier global strategic partners and renowned investment managers, PIF acts as the Kingdom's main investment arm to deliver a strategy focused on achieving attractive financial returns and long-term value for Saudi Arabia. PIF Program (2021-2025): https://www.pif.gov.sa/VRP%202025%20Downloadables%20EN/PIFStrategy2021-2025-EN.pdf A glance on the investments incentives given to foreign investors in Saudi Arabia

For more information on incentives given to investment in the industrial sector, you can refer to: https://mim.gov.sa/assets/IND_BOOKLET_V3.pdf

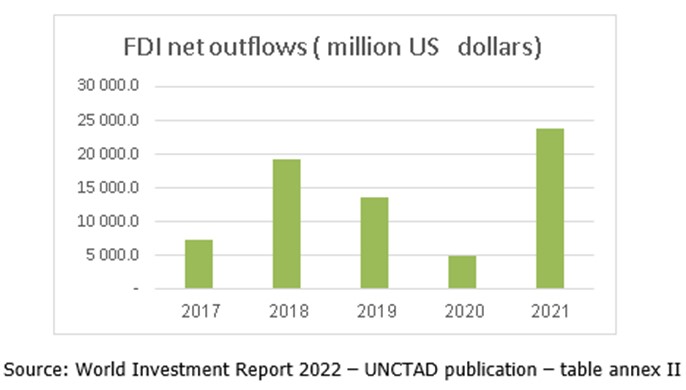

Main Giga Projects in Saudi Arabia 1. NEOM: NEOM is a living destination built on the Red Sea in northwest Saudi Arabia as a new model for sustainable living, working and prospering. NEOM will provide a plethora of unique development opportunities, as its strategic coastal Red Sea location is notable for its proximity to international markets and trade routes. 2. The Red Sea Project: luxury tourism development. The site encompasses an archipelago of more than 90 pristine islands, miles of desert and mountain landscapes. the Red Sea Project will mitigate carbon dioxide emissions, waste production, and light and noise pollution, maintaining the destination at a level equivalent to a Marine Protected Area. 3. Qiddiya: Saudi Arabia’s Capital of Entertainment, Sports and the Arts. As a core tenet of Vision 2030, Qiddiya, the largest water theme park in the region, has a dual economic and social purpose: to advance economic diversification and unlock new professional pathways while enriching lives of the youth in the Kingdom. FDI inflows Saudi Arabia is traditionally one of the largest recipients of FDI in West Asia. Net foreign direct investment (FDI) in Saudi Arabia surged to a total of $19.3 billion in 2021, a more than two-fold increase year-on-year, and the most since 2010. 2021 surge was due to the deal closed by Aramco with a consortium of global investors from North America, Asia, and the Middle East. Added to that, The Kingdom's Investment Ministry issued more than 3,300 new foreign investment licenses in the second half of 2021, a more than threefold increase from the same period in 2020. The wholesale and retail sector grabbed the bulk of the new license issuances (1,481) while the manufacturing and construction sectors claimed the second-and third-highest number of new licenses respectively. FDI outflows:

Saudi Arabia is among the top five economies in the world in terms of FDI outflows, with an average FDI outflow of 10 billion USD in the period from 2017-2021. According to the latest UNCTAD's World Investment report, there was robust outflows from Saudi in 2021, with a fivefold increase to 24 billion USD, thanks to the Public Investment Fund (PIF) which is the investment arm for the Kingdom, which has a large portfolio of investments either in MENA region or Internationally. Saudi Arabia is increasing its investments in the rest of the world, primarily in technology, finance, and infrastructure activities, driven by an investment push from its PIF and large private investors(7) (1) Trade Policy Review 2021 – WTO(2) Invest Saudi Portal(3) Trade Policy Review 2021 – WTO(4) Invest Saudi portal(5) Invest Saudi portal(6) The official portal PIF(7) Trade Policy Review, Report by the WTO - 2021 – Saudi Arabia |