Kingdom of Saudi Arabia

Kingdom of Saudi Arabia |

|

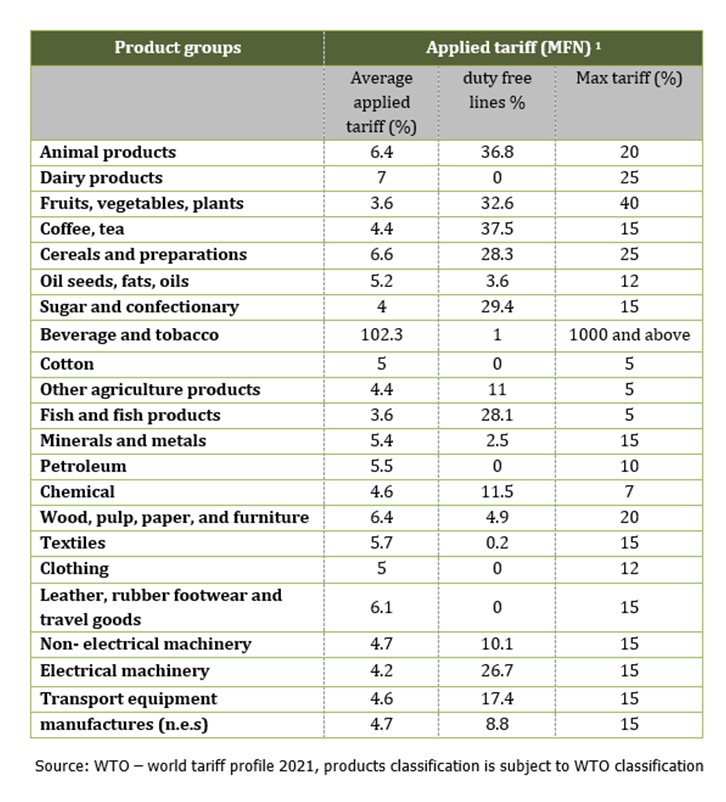

Trade barriers Saudi Arabia applies the GCC common external tariff. Under the "single port of entry" principle, items imported into Saudi Arabia (or any other GCC State), and destined for another GCC market, are subject to customs duty only at the first point of entry into the GCC. The full GCC Customs Union entered into force on 1 January 2015. However, there remain some differences in the implementation of the common external tariff, as each GCC member State has the right to keep lists of prohibited and restricted goods The following table shows the average applied MFN tariff on basic sectors

Please visit the dynamic tariff search introduced by the Saudi Customs to search for the customs tariffs https://www.customs.gov.sa/en/customsTariffSearch Tariff exemption Saudi Arabia grants tariff exemptions to national and foreign investors for imports of raw materials, machinery, equipment, and semi-manufactured substances required for industrial production based on the GCC Common Industrial Law. Exemptions from customs duties are also applied to investors in the mining sector, irrespective of an investor's nationality.(2) (1) MFN applied tariffs are the tariffs imposed on imports from all countries on equal basis. As an exemption of this rule are the countries that have preferential arrangements with the importer country.(2) Trade Policy Review – WTO Secretariat Report 2021

|